The main disadvantage of a receipt and payment account is that it does not provide a clear picture of the financial performance of an organization. It only records transactions as they occur and does not provide any information on the overall financial position of the organization. Additionally, it does not provide any information on the profitability of the organization, as it only records the inflow and outflow of cash. This makes it difficult for the management to make informed decisions about the organization’s financial performance.

Avoid missed payments with AutoPay

Receipt and Payment Account mainly focus on Cash and Bank transactions, the account will show all cash received and all cash payments made during the period, and it will show the net cash balance at the end of the period. To conclude, this account is just like a cash book that records all the money flowing in and all the money flowing out. No cash items are excluded and only cash and bank items are mentioned. This is mainly done by Non-Profit Organisations (NPO) as a record of maintaining accounts. The account is then further used for making Income and Expenditure accounts so it plays an important role in the whole accounting procedure. To know more about this account and what further uses it has you can read about Objectives of Receipt and Payment Accounting.

- It must be noted here that a receipt and payment account does not reflect the true financial viability of a Non-Profit.

- In this article, the readers will be able to know about the receipt and payment account and other related topics in detail.

- With faster payments, businesses can maintain a stable cash flow, enabling them to reinvest in operations or cover expenses without delay.

- Some payment app companies are able to invest users’ funds in loans and bonds, earning money on the investments while generally paying no interest on users’ balances, the CFPB found.

Gently Reinforce Payment Terms

With Cash App, funds are eligible for insurance if consumers link their account to a Cash App debit card. And with Venmo, funds added to an account via direct deposit or check cashing are covered. As use of payment apps has grown in recent years, the Consumer Financial Protection Bureau has issued guidance on best practices to avoid pitfalls.

Which financial statement is more focused on profitability?

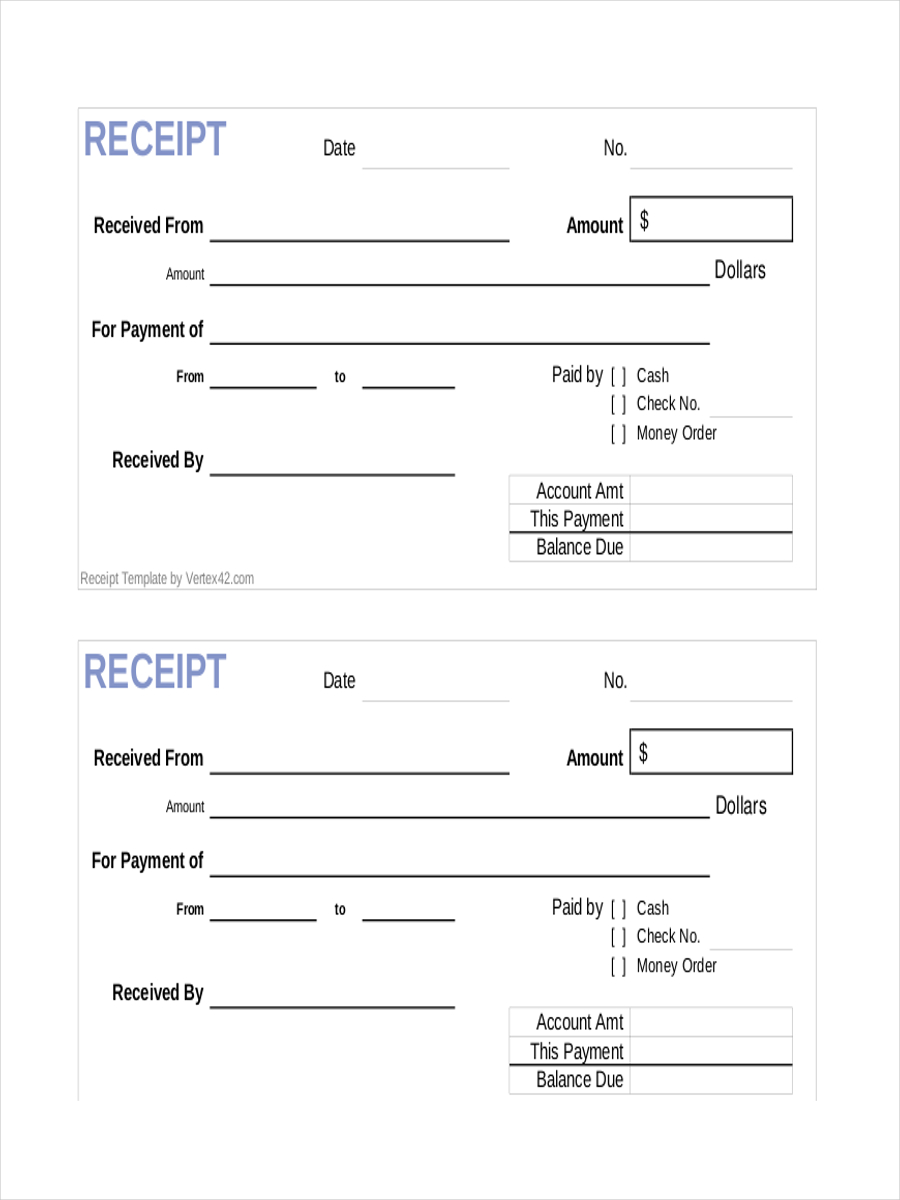

Identify and list all receipts where actual cash inflow occurs, such as subscriptions. Identify the various payments by taking into account if the mentioned records (for ex- machinery) have an outflow of cash because of the purchase nature. If yes, then record it on the Credit side under the Payments column.

‘Due Upon Receipt’ provides security against non-payment for new or higher-risk clients. You can minimize the risk of overdue invoices or bad debts by requiring immediate payment. In this blog, we’ll explore what ‘Payment Due Upon Receipt’ means, when to use it, its advantages and disadvantages, and how to manage invoicing when adopting this payment term effectively. Receipt and payment account is a very important topic for the commerce related exams such as the UGC-NET Commerce Examination.

Later, armed with some extra information, an income and expenditure (I&E) account is framed. It must be noted here that a receipt and payment account does not reflect the true financial viability of a Non-Profit. In the exam, you will be given all the figures for owing b/d, owing c/d, prepaid b/d, prepaid c/d and bank except income and expenditure. After you have calculated this, you will need to put this figure into income and expenditure account. Receipts and Payments Accounts is basically a new name for your cash book. The format is basically similar to cash book, with cash received being a debit entry and cash paid being a credit entry.

The last noteworthy feature of receipts and payments accounts is that they are always prepared at the end of an accounting period. In a receipts and payments account, all receipts are recorded on the left-hand (debit) side and all payments are recorded on the right-hand (credit) side. Given that the receipts and payments account is simply accounting cycle steps and examples what is accounting cycle video and lesson transcript a summary of cash transactions, it does not cover outstanding income or expenditure. Funds stored in payment apps often lack deposit insurance, the CFPB has found. FDIC-insured banks protect depositors against the loss of their insured deposits up to at least $250,000 if a bank fails, and a similar framework protects credit unions.

So, a receipt and payment account is a type of account that is prepared on the very last day of the accounting year. The account records all the cash amounts whether they relate to the previous year, current year or upcoming year, received or paid during an accounting period. This account is made by non-profit organisations with the sole purpose of recording transactions, further using it for income and expenditure accounts.